New Delhi: A 90-year-old man in Maharashtra was allegedly mis-sold a life insurance policy with an annual premium of Rs 2 lakh by a Canara Bank branch manager. This issue has sparked grave concerns about bank-led insurance sales that disregard the financial well being of senior citizens and put them thorough neddless financial stress in their final years.

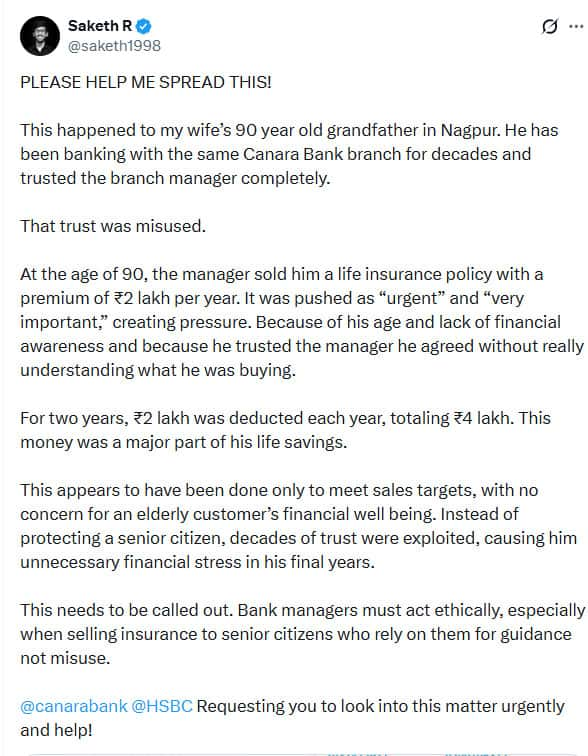

The allegation was made public by Saketh R on X who said that the life insurance policy was mis-sold to the 90 year old elderly man who is his wife’s grandfather. The man from Nagpur has been a customer of the Canara Bank branch for decades and had great faith in the branch manager but his trust was abused.

The manager sold the life insurance policy to the senior citizen with a premium of Rs 2 lakh per year with maturity date as 2124. Because of his age, lack of financial awareness and complete trust in the manager, the elderly man purchased the insurance policy.

Saketh said that for two years, Rs 2 lakh was deducted each year which totalled Rs 4 lakh. This amount was a major part of the life savings of the elderly man.

The user said that the manager might have sold the insurance policy to meet sales targets without caring about an elderly customer’s financial well being. Instead of protecting a senior citizen, the bank manager exploited decades of trust which caused unnecessary financial stress to the senior citizen in his final years.

Saketh said that bank managers must act ethically, especially when selling insurance to senior citizens who depend on them for guidance and not misuse.

A few hours later Saketh shared an update saying that the regional head and the branch manager visited the home on Sunday and helped resolve the issue promptly. They have assured that the amount will be refunded within a week.

Canara Bank and Canara HSBC Life Insurance respond on X

Canara Bank responded to Saketh’s post and said, “Hi Saketh, we regret the inconvenience caused to you. We will forward it to the concerned team. Also, we would request you to refrain from sharing your personal information openly on the public platform. Thank you!”

Hi Saketh, we regret the inconvenience caused to you. We will forward it to the concerned team. Also, we would request you to refrain from sharing your personal information openly on the public platform. Thank you!

— Canara Bank (@canarabank) February 7, 2026

Canara HSBC Life Insurance responded on X and said, “Dear Saketh, we are concerned about this matter and take such issues very seriously, especially those involving senior citizens. We have the necessary details and have initiated an internal review to understand the circumstances and take appropriate action.”

Netizens Reaction

The post received widespread response on social media with several users suggesting that the RBI and IRDAI should be contacted about the issue.

One user said, “Saketh, first step should be a proper written complaint to the bank and the insurance company. If they don’t resolve it within 30 days, escalate it to RBI Ombudsman and IRDAI. Mis-selling to a 90 year old is taken very seriously and many people do get refunds once it’s formally escalated.”

“Hi Saketh, the end step is RBI & IRDAI but there are ways to escalate it within the bank as well, if their social media team refuses to help, please DM, can try to assist,” said one user.

Another user wrote, “Write to @RBI @nsitharaman and to Consumer Court. The money should be returned along with interest. And an apology. @canarabank what nonsense is this by your staff? Abusing the trust of a super senior citizen.”

One user said, “Put the names of the Bank Manager and whichever executive sold him the policy here. Chances are the bank will throw them out and they won’t get another banking job. That should be a good deterrent. Also consider filing a police complaint for cheating against the BM at 100.”

Disclaimer : This story is auto aggregated by a computer programme and has not been created or edited by DOWNTHENEWS. Publisher: ZEE News