While the Dow Jones Industrial Average shattered records last week by crossing the 50,000 threshold for the first time, a leading financial strategist is warning that the numbers on the trading floor are masking a much grimmer reality for Main Street. In a new note to investors released Monday, David Kelly, chief global strategist at JPMorgan Asset Management, offered a blistering assessment of the nation’s financial health.

“It is an economy of soggy consumption, weak job gains and a sour public mood,” he wrote, explicitly countering the euphoria surrounding the recent tech-driven market rally.

The note highlights a stark disconnect between what Kelly called a “frothy” stock market—buoyed by liquidity and mega-cap tech earnings—and a sluggish real economy struggling under the weight of structural decline. While financial headlines celebrated the market’s historic high, Kelly pointed to data suggesting that the underlying economy is failing to deliver for the average American family.

‘Soggy consumption‘

Kelly’s analysis described the start of the first quarter as “rocky,” characterized by a notable pullback in consumer activity. Stripping away the temporary boosts from tax refunds or any “tariff rebate checks” that may materialize, he argued that the organic economic momentum appears to be stalling.

President Donald Trump has proposed sending Americans $2,000 checks as rebates to counter the tariffs’ impact on the economy, with one projection showing that would cost twice as much as the revenue being generated by the tariffs which keeps growing smaller anyway, with Treasury Secretary Scott Bessent calling them a “shrinking ice cube” in December. The tariff rebate idea appears dead on arrival in Congress.

Kelly wasn’t just basing his argument on vibes. The data paints a concerning picture for the retail and service sectors. January light-vehicle sales plummeted to an annualized rate of 14.9 million units—the lowest monthly rate in over three years and a sharp drop from the previous quarter. Meanwhile, the travel sector, often a bellwether for consumer discretionary spending, has flatlined; Transportation Security Administration numbers for January were stagnant, and hotel occupancy rates dipped 1% year over year.

Perhaps most troubling for the long-term outlook is the housing market. Traffic of potential homebuyers remains very weak, according to the National Association of Home Builders, dropping to 23 on the index, where any number over 50 indicates that more builders view conditions as good than poor. Rental vacancy rates, on the other hand, have climbed to 7.2%, their highest level since 2017.

“In short, while the stock market is booming and tech sector capital spending is soaring,” Kelly argued, “much of the real economy remains very slow.”

‘Weak job gains‘

Despite the administration’s promises of robust growth, the labor market is showing signs of exhaustion. Kelly characterizes the current dynamic as one of “low hiring, low firing and low growth,” recalling Federal Reserve Chair Jerome Powell’s comments to a similar effect.

Job openings have fallen to a five-year low, dropping from 6.9 million in November to 6.5 million in December. While layoffs remain relatively contained, the engine of job creation has sputtered. The gap between workers describing jobs as “plentiful” versus “hard to get” has narrowed to levels not seen since February 2021.

A significant driver of this stagnation, according to Kelly, is a demographic crisis. The Census Bureau estimates that the working-age population (ages 18 to 64) is currently shrinking by 20,000 individuals every month, exacerbated by a sharp slowdown in net immigration. “In a close-to-full-employment economy, you can’t add many jobs while shrinking the number of available workers,” he noted.

The strategist argued that the “sour public mood” is a reflection of this deepening economic inequality. While the stock market boom has enriched the wealthiest households, median household income growth has lagged significantly behind the average.

“The median American family is not doing nearly as well as the richest,” Kelly explained. In 2024, the gap between average and median income was 45%, a disparity that has widened consistently for decades. This inequality has left most Americans feeling that the economy is not working for them, driving consumer confidence to decade-lows.

Albert Edwards, the bearish analyst at Societe Generale known both inside his bank and throughout the industry for offering the alternative viewpoint, raised similar points in a note last week.

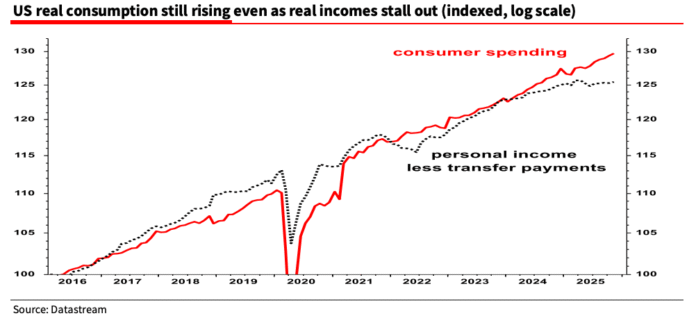

“There is a flipside to the emergence of an AI productivity ‘miracle,’” he wrote, noting real household incomes in the U.S. stalling despite consumption still powering ahead and anecdotes of university graduates struggling to find work.

Real household incomes have been flat for roughly six months, Alberts continued, slowing sharply to just 1% year over year, while the household saving ratio has collapsed to 3.5%.

That is the lowest since before the 2008 Great Financial Crisis, setting aside the temporary dip below 3% as households spent stimulus checks during the pandemic, Alberts noted. “That’s nuts!”

Political consequences

Kelly warned that this economic dissatisfaction could have immediate political ramifications for the Trump administration. With the midterm elections looming in November, the historical odds are already stacked against the White House. The party in power typically loses an average of 22 House seats in midterm cycles.

Axios recently reported that not only is the House surely going to swing back to Democrats, but Republican strategists are increasingly worried about losing the Senate, as well. This would be a “political earthquake” that would “neuter [Trump’s] last two years in office,” Axios said, with immigration and the economy now being liabilities for Trump rather than the strengths they were in 2024.

Given the current razor-thin majority of just five seats, Kelly predicted the House will return to Democratic control. Such a shift would likely gridlock Washington, effectively ending the prospects for further fiscal stimulus before the 2028 presidential election.

“Public discontent could fade in the months ahead,” he concluded, “but it may reassert itself later in the year… potentially dampening growth, inflation, interest rates and financial asset returns over the next 12 months.”

According to Edwards, the problem for anyone managing the economy is that “we are again in a Peter Pan world where an exuberant Wall Street is propping up the real economy. ‘Things’ could get interesting very quickly.”

Disclaimer : This story is auto aggregated by a computer programme and has not been created or edited by DOWNTHENEWS. Publisher: fortune.com