Morgan Stanley’s Bitcoin and Solana ETF filings show how crypto is moving from optional exposure to integrated wealth infrastructure—where bank control matters.

On January 6, Morgan Stanley filed Form S-1 registration statements for two new products: the Morgan Stanley Bitcoin Trust and the Morgan Stanley Solana Trust.

On the surface, the move looks like another addition to a rapidly growing list of crypto-linked ETFs. In reality, it marks something more structural.

This is the first time a major U.S. bank has put its own brand directly behind spot crypto exposure. Not as a custodian or a distributor – as the issuer.

That distinction matters because it signals a deeper shift in how crypto is entering the mainstream financial system.

The shift from distribution to ownership

The filings, submitted to the U.S. Securities and Exchange Commission, seek approval for spot exposure to both Bitcoin and Solana.

Unlike futures-based or structured products, spot ETFs directly track the price of the underlying asset, making them simpler, more transparent, and easier to integrate into traditional portfolios.

Asset managers have dominated this market since U.S. regulators approved the first spot Bitcoin ETFs in 2024.

Banks, by contrast, have largely stayed on the sidelines, limiting their role to custody or third-party distribution. Morgan Stanley’s decision to file its own trusts breaks that pattern and places the bank squarely inside the product stack.

Why bank-issued crypto ETFs are different

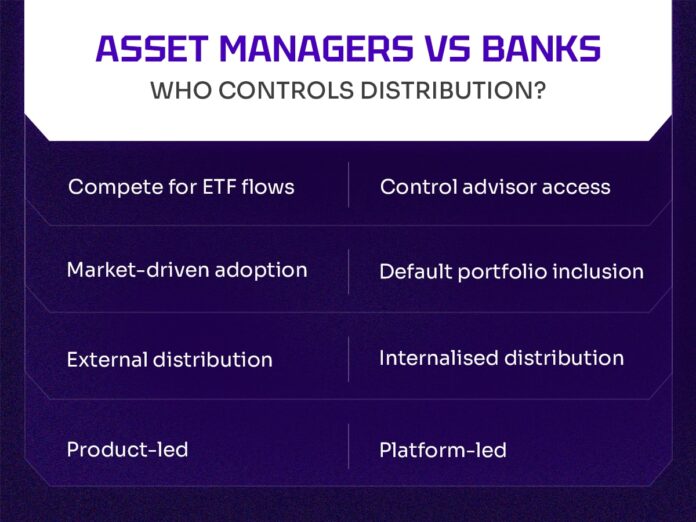

When asset managers launch ETFs, they compete for flows. When banks do it, they shape defaults.

Banks control advisor networks, model portfolios, and recommended product lists. By issuing its own ETFs, Morgan Stanley is internalising distribution and keeping fee revenue in-house.

Market analysts have highlighted how this changes competitive dynamics. As Bloomberg ETF analyst Eric Balchunas has noted, this gives Morgan Stanley the ability to steer client capital toward proprietary funds, even in an already crowded market.

“As crypto moves into bank-led distribution, enforcement becomes more important than access,” said Tapan Sangal, Chief Visionary at Kwala. “That’s where most of the complexity now sits.”

As crypto becomes embedded in bank-led distribution, execution increasingly hinges on compliance, consent, and enforceable controls: areas where infrastructure platforms like Kwala operate in the background.

Why this move wasn’t possible earlier

Timing is not incidental. Over the past two years, regulatory clarity has improved significantly. The approval of spot Bitcoin ETFs in 2024, followed by generic listing standards published in late 2025, reduced uncertainty around how crypto products can be launched and maintained.

At the same time, U.S. regulators have eased restrictions on banks acting as intermediaries in crypto transactions, narrowing the gap between traditional finance and digital assets.

These developments collectively lowered the operational and compliance barriers that once kept banks at arm’s length from crypto markets.

As a result, traditional financial institutions are now moving from experimentation to full product ownership in crypto markets.

Morgan Stanley’s internal groundwork

In October 2025, Morgan Stanley expanded crypto access across client types and accounts, allowing advisors to recommend limited allocations – typically between 1% and 4% – in higher-risk portfolios.

The bank has also been quietly scaling its ETF business, growing a multi-billion-dollar platform spanning active, systematic, and responsible investing strategies.

Launching crypto ETFs under the Morgan Stanley name signals conviction. It suggests the bank sees digital assets not as a tactical add-on, but as a long-term component of portfolio construction.

Who controls crypto access next

The broader implications extend well beyond two ETFs. Analysts expect more than 100 crypto-linked ETFs to launch in 2026, spanning spot assets, multi-asset products, and crypto equity baskets. As large platforms lift remaining restrictions, inclusion in model portfolios becomes the next major milestone.

Morgan Stanley’s ETF filing is not about chasing crypto cycles. It reflects a deeper shift in how wealth platforms decide what becomes investable at scale. As crypto products move into model portfolios and bank-controlled distribution channels, access is no longer defined by innovation alone, but by governance, compliance, and control.

When crypto becomes ordinary, the institutions that control distribution not just the assets themselves will define its role in global portfolios.

Also Read:

Topics

Disclaimer : This story is auto aggregated by a computer programme and has not been created or edited by DOWNTHENEWS. Publisher: india.com