I’ve been through the wringer with my taxes the past couple of years. Last year, I was a freelance writer for three different publications, across three states, with three types of tax documents. I also had two W-2s from two different employers. I also live in New York City, one of the most expensive cities in the world, with an astronomically high tax-withholding rate. Oh, and I was also enrolled in a university, which brought a separate slew of education-related documents.

I got off easy this year as I only had a W-2 (the most common type of tax document, which is probably what you’ll use) to file as I tested this year’s online tax services on my 2025 taxes, including H&R Block DIY online services.

Trust the Process

Although H&R Block has several ways to file (more on that below), I tried H&R Block DIY, which is self-guided and free. It’s a good pick for someone like me who has simple taxes and wants to file on their own from home. If you run into issues you can’t deal with on your own, it’s easy to bail out and upgrade to tax assistance services, which provide expert support for tougher questions.

Over half of filers qualify to use DIY, but note that this is limited to W-2s and 1040 forms—you can’t add on more obscure credits or schedules, as it only includes very common credits like the Earned Income Tax Credit, Child Tax Credit, Student Loan Interest, and Retirement Plan Distributions. (Sorry, you’ll need to upgrade to take deductions for donating deer meat or buying your business a guard dog.)

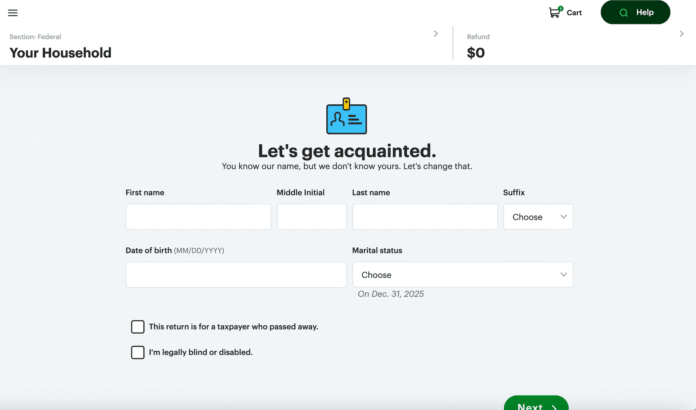

To file, I first gathered my W-2 form and related employer information like HSA, Roth 401(k) accounts, and health insurance information. I also tracked down charitable contribution receipts, work expenses, write-offs, and medical insurance information. I created an account and answered the basic questions like name, filing status, employment information, and other personal information. All of that only took about 15 minutes.

I ultimately went with TurboTax last year, and was able to easily import my tax documents and returns from last year into H&R Block’s portal. All I needed to do was input my phone number associated with my TurboTax account, and after login and verification, the information was pulled directly into H&R Block’s portal, which was easy and saved me a ton of time. (You can also upload last year’s tax file in .tax format or a PDF of the return.)

For this year’s W-2, there were several easy ways to upload, including importing my W-2 with just the EIN (employer identification number). Since my employer provided one, it was able to auto-sync my payroll info, which saved me tons of time by auto-filling and importing all of the crucial information. You can also enter info manually from the details on the form; snap a picture and upload to the portal, where details will be filled for you; and upload a PDF, where the information will auto-fill.

Next is deductions, where you figure out if you should take standard deductions or itemize. The interface prompts you with easy-to-understand buttons, and you’ll click each that applies. In this section, H&R Block provides answers to common Q&As—in this case, explaining what deductions are and how they can help you lower the amount of taxes owed.

The IRS lets you either take the standard deduction (which is $15,750 this year for single filers) or itemize each of your individual deductions. Itemized deductions aren’t set amounts like standard deductions, and are made up of deductible expenses. If these expenses add up to more than you can claim with the standard deduction, you should itemize your deductions.

Then, you’ll need to figure out credits, like the Earned Income Credit (EIC), Schedule 8812

(Child Tax Credit), Form 8863 Education Credits, and more. And again, there’s a helpful sidebar to let you know how these credits help lower taxes. Credits help reduce the taxes owed and are applied after deductions, and are either refundable or nonrefundable.

Throughout, there’s a Virtual Assistant chatbot if you need to ask questions or get help, which gives me extra peace of mind. Plus, it’s included with the DIY service, which saves me a bunch of money, rather than going with one of the options that includes a real tax expert to look over things.

H&R Block’s service asks lots of questions related to potential tax breaks, looking for savings that can come, for example, from cash and noncash charitable donations, and H&R Block was able to find more tax breaks to maximize my refund.

Health-y Questions

The biggest difference I noticed was in a section about health care, which was filled with helpful information about coverage and its effect on taxes. Most of the other tax services I’ve tested didn’t include health care questions, and didn’t explain this clearly with helpful FAQs.

I had to answer questions about household health insurance statuses in 2025. H&R Block is very thorough in asking questions and providing information about the types of insurance that qualify for tax benefits, and even whether Medicaid coverage for Covid-19 testing and services counts as health insurance. If health-related expenses play a prominent role in your personal finances, I’d opt for H&R Block’s tax service over competitors.

Pro tip: The early bird gets the worm, and it’s the same with taxes. Generally speaking, the earlier you file, the better price you’ll get for these online filing services. Like H&R Block, most services have a tier system with different plans, and the same goes for when you choose to file. The end of January is the cheapest time to file, and early February is the second cheapest, with prices increasing the closer you get to that April 15 deadline. Oftentimes, H&R Block holds a Presidents’ Day Sale for a week or so, so if you’re planning to go with this already super-affordable service, I’d keep an eye out for sales during that period.

Overall, I found H&R Block’s DIY online self-service to be easy and pretty seamless. The supplemental information helped me understand the process, and the file upload options saved me tons of time. Plus, I loved having the Al Tax Assist for extra help with questions, and Live Tax Pro Support on the ready to give my forms a second look.

As mentioned, there are several different options available for filing, as well as expert support provided (if you opt in to this service) tailored to unique tax situations to ensure you’re getting the most money back. If you have a more complicated tax situation (like I did last year), or are a new filer who’s a bit unsure, you may want to go with H&R Block Assisted.

With this service, you can get done with filing in as little as one hour. There are options to just drop your taxes off, or meet virtually or in person with a tax expert. H&R Block has more than 60,000 tax professionals and 9,000 offices, with locations in every state, within 5 miles of most Americans.

Disclaimer : This story is auto aggregated by a computer programme and has not been created or edited by DOWNTHENEWS. Publisher: wired.com

.png)

.png)