For decades, the United States dollar has been more than just a currency — it has been the bedrock of global trade, finance, and power. Washington’s ability to weaponize the dollar — from freezing assets to enforcing sanctions and controlling international payment networks — has long cemented its geopolitical leverage.

But that monopoly is now facing an unprecedented challenge. US President Donald Trump has repeatedly slammed the BRICS, accusing the organisation of attempting de-dollarisation. India’s trade with Russia in Indian rupees has also hurt the dollar. And China is now coming up with something big.

China’s Landmark Digital Leap

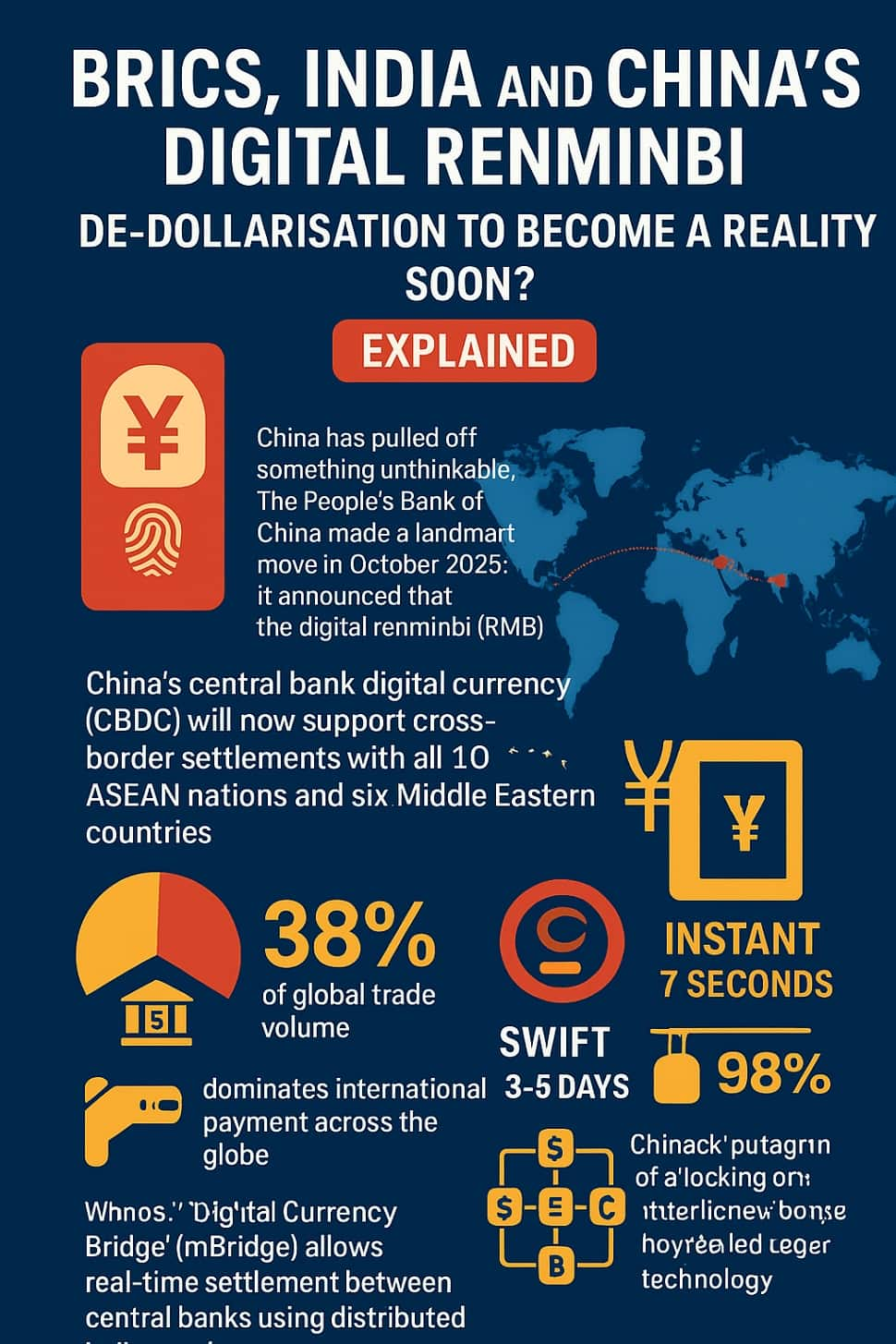

In October 2025, the People’s Bank of China (PBoC) made a historic announcement: its central bank digital currency — the Digital Renminbi (e-CNY) — would now support cross-border settlements with all 10 ASEAN nations and six Middle Eastern countries.

This expansion connects nearly 38% of global trade volume directly to China’s blockchain-based financial infrastructure, bypassing the traditional SWIFT system, which has served as the backbone of U.S. dollar–denominated payments for decades.

The implications are profound.

In pilot tests between Hong Kong and Abu Dhabi, the PBoC’s “Digital Currency Bridge” (mBridge) enabled cross-border settlements in just 7 seconds, compared to SWIFT’s 3–5 day window, and slashed transaction fees by up to 98%. The mBridge system — developed jointly with the UAE, Thailand, and Hong Kong — allows central banks to settle directly via distributed ledger technology, eliminating intermediary banks in New York or London.

For countries wary of US sanctions or payment blocks, this offers something SWIFT cannot: monetary sovereignty.

Beijing’s De-Dollarisation Strategy

China’s digital currency expansion isn’t just a financial experiment — it’s part of a long-term geopolitical strategy. The Digital RMB merges economic sovereignty, technological innovation, and statecraft.

As of early 2025, BRICS nations use the yuan for about 24% of intra-bloc trade, while roughly 90% of their total trade is now settled in local currencies.

Several ASEAN economies — including Malaysia, Singapore, and Thailand — have begun holding RMB in their reserves and using the digital yuan for energy or commodities transactions.

Middle Eastern exporters are increasingly open to settling oil and gas trades in RMB, drawn by faster and cheaper settlement options.

By creating an alternative financial infrastructure that is faster, cheaper, and sanction-resistant, Beijing directly challenges the three pillars of US dollar dominance: Oil trade, SWIFT intermediaries, and Dollar-denominated reserves.

This is more than economic competition — it’s the creation of a parallel financial world.

Why Emerging Economies Are Pivoting to CBDCs

Developing economies today face three choices for international transactions:

* Stay tied to SWIFT and the dollar — slow, expensive, and politically controlled.

* Depend on volatile cryptocurrencies — fast but legally uncertain.

* Adopt Central Bank Digital Currencies (CBDCs) — fast, sovereign, and regulatory-compliant.

CBDCs, unlike crypto, offer finality, compliance, and legal clarity, making them attractive for governments seeking both financial inclusion and geopolitical autonomy.

China’s digital yuan has proved that CBDC rails can function at scale — secure, instantaneous, and state-backed. This has quietly triggered interest from Africa, Latin America, and parts of Asia, where nations view CBDCs as low-risk, high-efficiency alternatives to the dollar system.

India’s Counter-Strategy: A Democratic Digital Currency

While Beijing races ahead, India is charting its own digital path. The Reserve Bank of India (RBI) has been developing the digital rupee (eRs) — a blockchain-based CBDC designed not to replicate China’s system, but to offer a more open, inclusive, and multipolar model.

India’s approach emphasizes interoperability over dominance. Rather than joining the RMB rails, New Delhi aims to build parallel digital corridors that reinforce its monetary sovereignty while enabling South–South trade integration.

Key features of India’s eRs ecosystem include:

* Retail and wholesale versions: for citizens and institutions alike.

* Offline transaction capability, enabling digital payments in rural and underconnected areas — a unique inclusion measure absent in China’s model.

* Pilot corridors with UAE, Singapore, and Central Asian nations, enabling near-instant rupee settlements independent of SWIFT.

* UPI integration for cross-border payments, leveraging India’s fintech leadership to democratize global access.

India envisions its digital rupee not just as a national instrument, but as a neutral reserve option within BRICS+, offering smaller economies a trust-based, transparent alternative to both the US dollar and the tightly controlled RMB.

BRICS and Battle For Financial Multipolarity

Within BRICS, the debate over de-dollarisation has shifted from rhetoric to infrastructure.

Russia is using the yuan for more than 30% of its trade after being cut off from SWIFT.

Brazil and South Africa are experimenting with blockchain-based payment systems.

Saudi Arabia, a potential BRICS+ member, has expressed openness to trading oil in non-dollar currencies, including the RMB and INR.

Together, BRICS nations now account for over 36% of global GDP (PPP) and more than 40% of global oil production — a scale large enough to sustain alternative settlement ecosystems.

The next phase, experts say, will involve inter-CBDC interoperability — the ability for India’s e?, China’s e-CNY, and other BRICS digital currencies to transact seamlessly through standardized, regulated frameworks.

The Dollar’s Future: Still Dominant, but Not Untouchable

The US dollar remains the world’s leading reserve currency — accounting for about 58% of global reserves as of mid-2025 — but that share has been steadily declining from 71% two decades ago.

De-dollarisation is unlikely to be abrupt; instead, it will evolve as a multi-currency ecosystem, where CBDCs, digital corridors, and local settlement systems gradually erode US dominance.

For Washington, this represents not an immediate collapse, but the slow unbundling of financial hegemony — a world where power no longer flows through one currency, one network, or one capital.

The Bottom Line

The rise of the Digital RMB and India’s eRs signals the dawn of a new financial era. China’s model offers speed and state control; India’s promises inclusivity and cooperation. Both converge on one truth: the dollar’s unchallenged reign is ending — not with confrontation, but with code, connectivity, and currency innovation. However, the US is also not likely to see this happening quietly. It might try to coerce or manipulate nations in trade in only dollars and not in other currencies. This might create a geopolitical tension, instability and competition as well.

Disclaimer : This story is auto aggregated by a computer programme and has not been created or edited by DOWNTHENEWS. Publisher: ZEE News