Simon JackBusiness editor

AFP via Getty Images

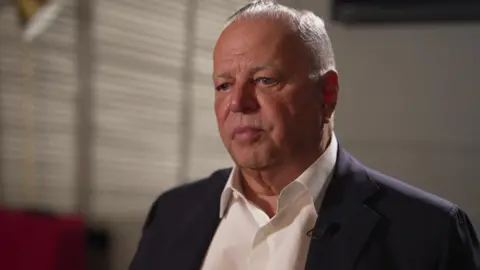

AFP via Getty ImagesThe UK was the most attractive place to list shares of the global energy and metals company Metlen, according to its founder and CEO.

Evangelos Mytilineos told the BBC that “the tide was turning” after a rocky period after Brexit when the London Stock Exchange looked unattractive.

His comments are in contrast to recent widespread concern about the steady outflow of some big name companies from UK markets, particularly to the US.

However, Mr Mytilineos said high energy costs were an obstacle to European and UK customers and he believed politicians had failed to be honest about the costs of the energy transition.

Metlen employs nearly 10,000 people in 40 countries and moved its primary listing from Athens to London in August this year. With a total value of over £5 billion, it was the fastest company to be admitted to the FTSE 100 list of the UK’s most valuable listed firms.

The move comes after some big UK companies quit the London Stock Exchange to sell their shares on foreign markets. Tech giant ARM Holdings is now listed in New York. Paddy Power’s parent company Flutter is betting on the US, and mining giant BHP headed down under to Australia. Rumours also remain over the future of London stalwarts Shell, and UK’s most valuable company, Astra Zeneca.

Mr Mytilineos said that while he had been attracted to the potentially higher valuations offered by US markets, he felt that London was a better cultural and business fit.

“First of all, most of our executives have started in England,” he said. “They all feel at home in the UK. We have a substantial part of our business in the UK, and most of the rest of the business is in Europe. Not much to do with the US.”

He said US stock exchanges were “overcrowded” adding “I don’t think we would get people to take the same interest in the company [in the US].”

Mr Mytilineos said the London Stock Exchange had appeared “neglected” in the years after Brexit but that other financial centres had failed to capitalise.

“Frankfurt, Paris, Milan or Amsterdam have not managed to overtake London and having withstood a difficult period, I think is on course to get back to the top,” he said.

Uk energy prices ‘not affordable’

The Metlen CEO was less flattering about UK and European energy policy which is crucial to his business – “a bit of metal is essentially energy in solid form,” he said.

Mr Mytilineos is also the president of Eurometaux, Europe’s association for the non-ferrous metals and said that higher energy costs compared to the US had ravaged the membership.

“The situation with energy costs in the UK and in Europe for the industry is not viable,” he said.

“We have hundreds of members. A large number of the most electro-intensive have gone out of business in the last three years. All of them because of the price of energy. They just cannot be competitive. It’s as simple as that.”

He said that while he was “in favour of the green transition”, politicians had not been honest about the costs of the enormous investments needed in the energy infrastructure to bring it about.

He said the majority of firms had been eager when asked by politicians ‘do you want us to go ahead, full speed on the Green Revolution?’

“But the question should have been, are you prepared accepting the fact that 30% of your salary for the next 30 years would have to be spent in the green transition, and then maybe the answer would have been very different,” he said.

Political messaging

He said the experience of watching investment push bills up in the UK and Europe was making messaging coming out of the US more politically attractive to some.

He pointed to US President Donald Trump’s speech to the United Nations last month in which he denied climate change, calling it the “greatest con job ever perpetrated on the world”, and refuted the use of renewable energy.

“I mean, it influences a lot of people in the world,” said Mr Evangelos. “So you may start to see, like we’re seeing in Europe, especially, right wing parties to start blocking more and more measures for the energy transition.”

The answer, he argues, is having a more honest debate.

“We have to measure the needs of the societies and the means of achieving our goal, what we have, and how do we get there?” he said.

He said a debate on energy transition had never happened on a grand scale.

“Let’s sit down. How much money we have, how much of that can we spend on infrastructure?” he said. “And let’s go out and explain to the people, unless we do that, we are not going to have them on board, and there will be more and more resistance.”

He seemed confident that the UK and EU could come to a deal over steel tariffs.

To protect EU steel makers, the bloc is proposing a 50% tariff from June next year on all imports from the rest of the world – including the UK.

He said co-operation in areas like defence had sweetened the relationship.

“My take from Brussels is the climate towards the UK is much friendlier than it was three, four or five years ago. The fact that the UK is very willing to support Europe on the defence side – I think the climate is much warmer now to make a deal on these issues”.

Disclaimer : This story is auto aggregated by a computer programme and has not been created or edited by DOWNTHENEWS. Publisher: BBC