Newly obtained Jeffrey Epstein emails expose how the late convicted pedophile kept investing and advising billionaires through his deep Wall Street ties — despite his 2006 arrest and 2008 guilty plea for sex crimes, according to a report.

The new cache of more than 18,000 messages reveals how Epstein invested $1 million in a prestigious hedge fund just weeks after allegations of Epstein paying teenagers for sex first surfaced.

They also lift the veil on how he leveraged his relationships with top banks, brokers and investment firms, according to Bloomberg News. The Post has approached individuals and companies mentioned in the latest document dump for comment.

The messages show Epstein, a one-time Bear Stearns banker, pumped $1 million into Renaissance — a hedge fund renowned for its secretive, high-performing strategies — shortly after Epstein was charged in summer 2006 for sex trafficking of minors and conspiracy to commit sex trafficking of minors.

Greg Hersch, then a wealth manager at Smith Barney, a brokerage firm owned by Citigroup, emailed Epstein’s office in August of that year and urged him to invest before the fund closed to new clients.

“I feel it would be a mistake to not make this investment,” Hersch wrote in an email quoted by Bloomberg.

That was despite media coverage of the allegations, including a Palm Beach Post editorial two days later, headlined “He was over 50. And they were girls.”

Epstein responded promptly through his chief investment vehicle, Financial Trust Company: “Fine.”

Hersch, who now runs his own firm, told Bloomberg through a spokesperson that his interactions with Epstein were solely professional and ended in 2007. That was before Hersch says he learned of Epstein’s crimes.

Earlier this year, House Democrats released thousands of Epstein emails in an attempt to smear President Trump. The messages evidenced the disgraced financier’s ties to high-profile figures including former Treasury Secretary Larry Summers but suggested zero misconduct by the president.

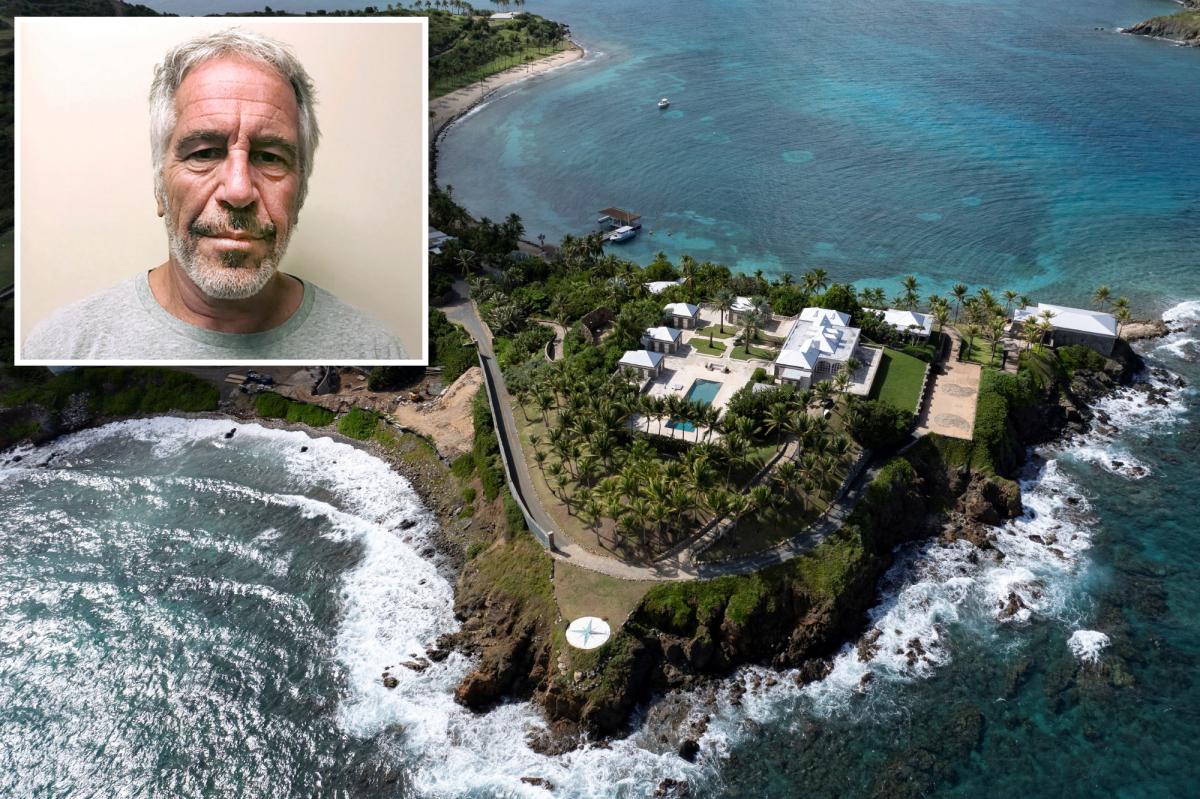

The latest batch of emails underscored the aggressive Wall Street tactics used by Epstein — a former math teacher without a college degree who became a globetrotting money manager with his own private Caribbean island, where he threw parties for the rich and famous.

The messages also spell out threats of lawsuits against former associates and persistent pitches from investment firms post-conviction, even as he served about 13 months in a Florida jail for procuring minors for prostitution.

Epstein’s dealings with Bear Stearns, the investment bank where he worked early in his career, were particularly contentious.

After leaving the firm in 1981 amid questions over a stock loan that might have violated securities laws, Epstein later invested tens of millions in its funds and stock.

He managed trusts for Bear’s then-CEO James “Jimmy” Cayne and oversaw money movements for key client Les Wexner, the Ohio billionaire behind Victoria’s Secret.

When Bear’s hedge funds collapsed in the 2007 subprime mortgage crisis, Epstein initially joined other investors in plotting to oust directors and investigate losses, the emails quoted by Bloomberg show.

But he flipped sides, sharing intelligence with Cayne and refusing to vote against the firm, drawing ire from fellow investor Charles Fix, heir to a Greek beer fortune.

“It is with particular ill grace that you are trying to suggest that Mr. Epstein claims ‘surprise’ at our being angered by his (and your) misconduct today,” a colleague of Fix’s wrote in an email.

Epstein forwarded it to Cayne, who died in 2021.

By June 2008, as Epstein negotiated his controversial plea deal, a draft lawsuit in the emails sought over $70 million from Bear Stearns and executives, alleging they dumped “toxic waste” — worthless or high-risk assets — into funds and betrayed a “special continuous 32-year relationship.”

The suit claimed fraudulent misrepresentation.

After Bear’s collapse and acquisition by JPMorgan Chase, Epstein sued in 2009 and settled for about $9 million in 2011, according to court documents obtained by Bloomberg.

In early 2008, Yin Harbor Drive Capital pitched Epstein on profiting from market declines, with executive Duncan Yin following up: “I hope that you found the discussion as interesting and thought-provoking as I did.”

Talks persisted, including a $5 million investment offer from former Bear executive Bruce Jaeger in June, as Epstein finalized his plea.

“It was great to see you on Monday, and I am glad to see that you are keeping such a positive attitude,” Jaeger wrote, according to an email seen by Bloomberg.

“I am sure that you will prevail and make the right decision on how to proceed.”

Jaeger didn’t comment to Bloomberg.

Morgan Stanley contacted Epstein’s deputy in 2016 about “risk reversals,” a strategy involving buying one option while selling another to hedge bets.

Epstein’s role extended beyond personal investments to advising ultra-wealthy clients.

For Wexner, emails show Epstein dictating family office operations, such as time off, jet payments and executive decisions.

A Wexner spokesperson declined to comment to Bloomberg.

With Apollo Global Management co-founder Leon Black, Epstein positioned himself as a “daddy” for Black’s family office in 2015 emails: “Your family office needs a daddy. children with good intentions are running around , sniping , nitpicking with little direction.”

He even demanded fees: “very serious I am wiling to continue to accommodate some of your concerns , but I am, under no circumstances , none, willing to spend my time for free. its [sic] not fair.”

Black declined to comment to Bloomberg.

In 2006, Merrill Lynch advisor Ed Spector advised on currency trades, splitting $10 million between Epstein’s firm and Wexner.

But Epstein pressed for an unspecified favor that Spector deemed risky: “as innocent as the request may sound, it could result in big problems for me internally if this gentleman doesn’t think its an appropriate conversation. There is zero tolerance in the organization.”

Spector fired back: “Jeffrey, As you know, I have a great deal of respect for you. I have asked around this afternoon after receiving your email on a no name basis and have been advised that I can have significant issues approaching the topic. I hope you understand.”

Yet business continued, including a $2.2 million Hertz payout and invitations to “billionaire-only deals” requiring $20 million annual commitments. Spector died in 2009.

Epstein was even pitched to invest in a musical in 2018, by a deputy for music mogul Tommy Mottola.

Epstein was hit with federal charges of sex trafficking minors a year later, dying by suicide in New York City’s Metropolitan Correction Center before his trial started.

His infamous madam, British socialite Ghislaine Maxwell, is currently serving a 20-year federal jail sentence after being convicted on sex trafficking charges.

Disclaimer : This story is auto aggregated by a computer programme and has not been created or edited by DOWNTHENEWS. Publisher: nypost.com