ASC 360 governs tooling capitalization, requiring disciplined judgment to balance asset recognition against impairment risks, ultimately shaping long-term financial performance.

Overview of ASC 360

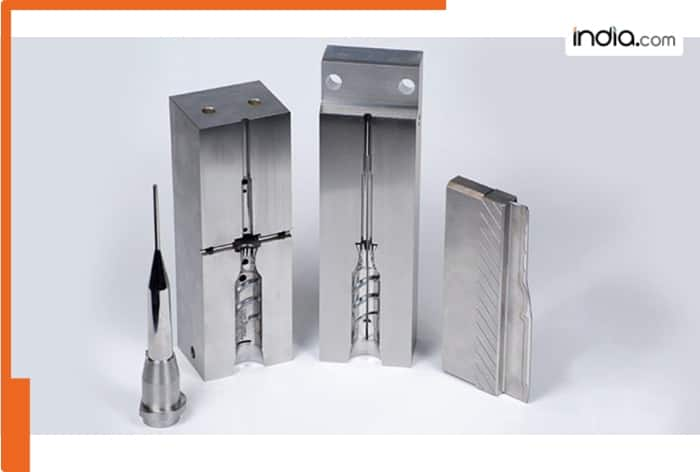

ASC 360 ( Property, Plant, and Equipment ) regulates recognition, measurement, depreciation, and impairment of long-lived serviceable property. Tooling – molds, dies, jigs, fixtures, and other special production equipment is often treated as a long-lived asset in that it gives future economic use beyond one production cycle and is utilized in production over many cycles.

Under ASC 360, the capitalization of tooling is necessary when:

- It is owned by the entity,

- It is applied in the creation of goods or services and

- It yields multiple accounting period future economic benefits.

- At this point, tooling is documented as PPE and is not expensed.

- Capitalization vs. Expensing: The essence of Judgment.

One accounting judgement of ASC 360 is whether the tooling costs should be:

In capitalized (an asset that is being depreciated) or

Immediately expensed (treated as period cost).

Tooling is capitalized when:

- It is dedicated to a specific product or customer program,

- It has a determinable useful life, and

- It supports repeat or serial production.

Tooling is typically expensed when:

- It is for prototype or trial production only,

- It is immaterial, or

- It has no alternative future use.

This decision materially affects financial statements, especially in capital-intensive industries such as automotive, aerospace, and industrial manufacturing.

3. Initial Measurement

Under ASC 360-10-30, capitalized tooling is measured at historical cost, including:

- Purchase price or fabrication cost,

- Freight and installation,

- Testing and commissioning costs,

- Engineering or design costs directly attributable to the tooling.

Costs related to inefficiencies, abnormal waste, or training are excluded and expensed as incurred.

4. Depreciation Method and Useful Life

Once capitalized, tooling is depreciated systematically over its useful life, which may be based on:

- Contractual production volume,

- Expected production cycles, or

- Time-based estimates (e.g., 3–7 years).

Common methods:

- Straight-line, when benefits are evenly consumed,

- Units-of-production, when wear correlates with output.

The choice of method should reflect the pattern of economic benefit consumption.

5. Impairment under ASC 360

Tooling is subject to impairment testing when triggering events occur, such as:

- Program cancellation,

- Loss of customer contract,

- Technological obsolescence, or

- Significant decline in expected production volumes.

Recoverability is tested by comparing undiscounted cash flows to carrying value. If not recoverable, the asset is written down to fair value.

6. Financial Statement Impact

Proper tooling capitalization materially affects:

Income Statement

- Capitalization increases EBITDA by shifting costs from immediate expense to depreciation.

- Improves short-term margins and operating profit.

Balance Sheet

- Increases PPE and total assets.

- Improves asset base for ROA analysis (though depreciation reduces over time).

Cash Flow Statement

- Reclassifies costs from operating to investing activities.

- Improves operating cash flow metrics.

This makes tooling capitalization a strategically significant accounting policy choice in manufacturing businesses.

7. Internal Controls and Audit Considerations

Strong governance is required:

- Formal capitalization policy aligned to ASC 360,

- Engineering sign-off on useful life estimates,

- Clear documentation of customer ownership vs. company ownership,

- Periodic impairment reviews.

Auditors focus on:

- Ownership and economic control,

- Useful life assumptions,

- Consistency of application across programs.

8. Strategic and Operational Relevance

- Beyond compliance, tooling capitalization influences:

- Pricing decisions (tooling amortized into unit cost),

- Capital budgeting and ROI analysis,

- Contract negotiations with OEM customers,

- Long-term profitability modeling.

When applied consistently and analytically, tooling capitalization under ASC 360 becomes both an accounting and strategic financial management tool.

9. A Practical, Step-by-Step Framework for Tooling Capitalization

In practice, I approach tooling capitalization under ASC 360 by following a structured, step-by-step decision process rather than relying on isolated judgment calls. First, I confirm ownership economics—whether the tooling is owned or economically controlled by the company and whether future benefits truly accrue to the entity. Next, I assess program specificity, determining whether the tooling is tied to a repeat or serial production program rather than prototype or trial use. I then validate the useful life by working closely with engineering to confirm expected production cycles or time-based utilization. After that, I evaluate production volume sensitivity, ensuring that the capitalization and depreciation pattern aligns with how economic benefits are consumed. Finally, I explicitly assess impairment probability, considering customer dependency, program cancellation risk, and technological obsolescence.

By moving through these steps in sequence, what is often a subjective accounting judgment becomes a disciplined, auditable framework that can be consistently applied across tooling programs and reporting periods.

10. Conclusion

Tooling capitalization under ASC 360 is not a mechanical exercise; it requires professional judgment, operational insight, and disciplined governance. Correct application ensures faithful representation of economic reality while materially shaping profitability, asset valuation, and financial performance trends. In capital-intensive manufacturing environments, tooling accounting policy can be one of the most consequential levers of reported financial outcomes.

Also Read:

Topics

Disclaimer : This story is auto aggregated by a computer programme and has not been created or edited by DOWNTHENEWS. Publisher: india.com